TAPOVAN

Impact of Covid-19 on real estate in India

“India’s real estate sector might have suffered a setback during the first and the second wave of the COVID-19 pandemic but housing demand in the country has revived.”

- Durga Shanker Mishra, Housing secretary. (25 July, 2021)

Introduction

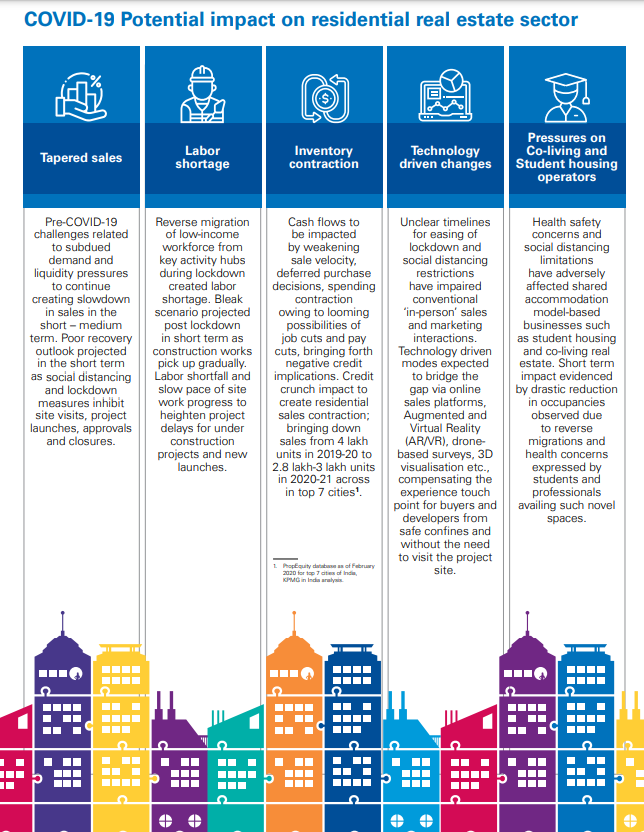

Buying a home is a significant milestone in one’s life. It takes a lot of thought and emotional labour and hard work to be able to do so. People would like to see the locations, get a feel of the property, learn about the community, and understand more about it before making the decision. None of this is possible as an effect of the lockdown. Along with this, the construction is being disrupted as workers have returned to their hometowns and raw materials are not being delivered on time. The table below shows detailed setbacks faced by real estate developers based on a study by KPMG.

So, If you thought the lockdowns had people investing less in property – think again.

There are several factors that contributed to almost a 44% increase in real-estate spending. Want to know which factors? Read on to know the trends that will dominate the real estate market for the rest of this year.

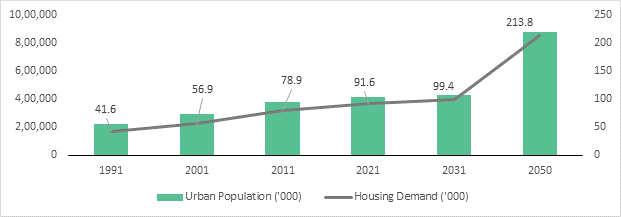

Younger home buyers:

Skeptical? See the findings from the graph

Work-from-home:

The work-from-home trend is here to stay. Individuals will continue to desire larger homes with convenient home offices now more than ever. With most of the companies adapting a blended approach where there are options to choose to work-from-home, a lot of employees are shifting back to their hometowns to spend more time with their families while working. It is also a wiser option to choose to keep safe while allowing to save more. Hence, people will continue to buy properties in their hometowns as a result of online operations. Therefore, the market in tier 2 and tier 3 cities is projected to be substantially higher.

Lower home loan rates: Various firms have reduced their fixed deposit interest rates as a result of the Reserve Bank of India’s decision to retain the interest rates at a low of 4% for more than a year, demoralising clients. This factor has led previously hesitant purchasers to take the plunge and buy a home. Interest rates on home loans are currently at a 15-year low.

Real Estate Investment Trusts (REITs)

Even though REITs have always been a good investment, the scope for it has rapidly increased since the pandemic as people are keener and are being more attentive on where they invest their savings. Hence, REITs have emerged as one of the most realistic investment options when compared to traditional property buying because 80 percent of the underlying assets must be operational and income-generating. It has been shown to be a reliable and low-risk method of diversifying an investment portfolio.

Increased options given by developers:

Despite fears and low expectations, real estate will most certainly survive and eventually prosper in the post-covid era, although in a new form. The long-term housing demand trend remains progressive. Homeowners, purchasers, and sellers (or “consumers”) prefer to live in houses that are pleasant, safe, low-maintenance, and inexpensive, according to NAR research. Greener homes provide all of these advantages. Even though, Covid-19 has halted the economy in the short term, it will always be the best option to choose for the long term investment. Staying at home and being completely shut down from the outside world, we have had such an impact on our lives that many of us are considering resetting our “live, work, learn, play” schedule. Instead of procrastinating, now is as good a time as any to act, although cautiously. Because real estate as an asset class will emerge stronger after surviving this crisis.